3 Easy Ways to Turn Prospects from Cold to Warm

Quick wins to enhance your outbound prospecting efforts

If you’re in a position where your outbound program (ie startup rep or founder) is still developing or you’re still learning about your ICP and messaging - today’s posts will provide some application on how to approach “cold” outbound in a “warm” way.

Brand equity is helpful in any scenario where you sell, but it doesn’t make prospecting any easier. Despite having brand equity or a well tuned marketing org, outbound and prospecting is still going to be hard.

Below are some tactics that I use in my current role when prospecting so if you are still learning about your ICP messaging, or trying to do more with less, here are some applications that I use, and have recommended to others, that help.

I recently had the chance to connect with a rep whose organization was developing their outbound program. The questions that surfaced in approaching GTM was how to leverage existing data to find low hanging fruit.

I’ve written about finding quick wins by using your existing data but let’s dig into some ways that might be not often thought of that can bear a lot of fruit.

Here’s what we’ll cover today:

What does the competition not have?

Leveraging past companies and experience (not UserGems)

Tightening up industry/vertical specific messaging

What does the competition not have?

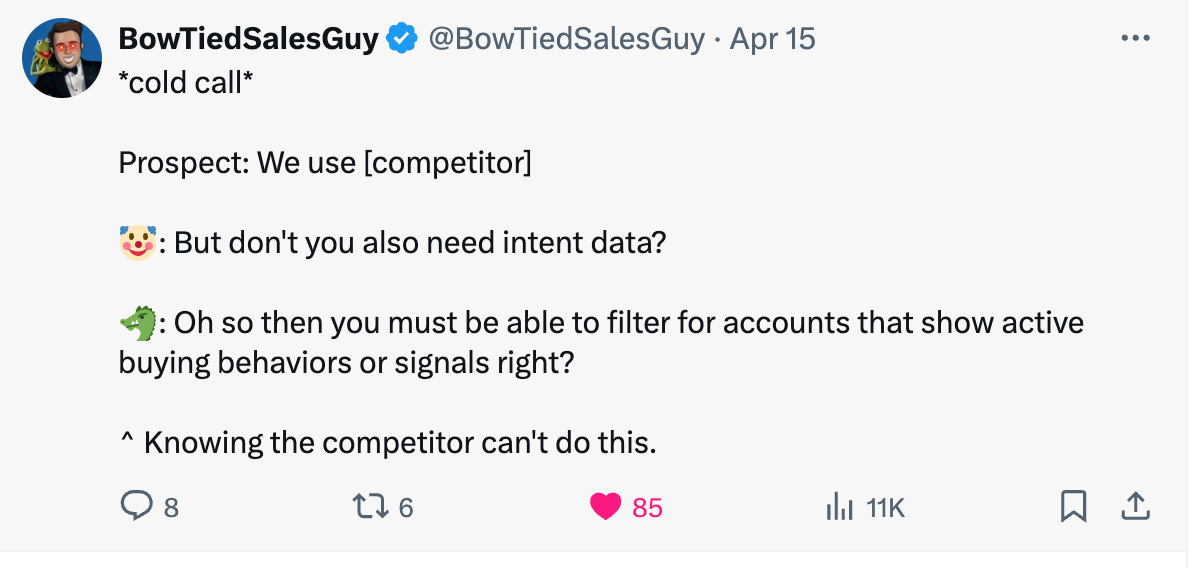

Credit: BowTiedSalesGuy

This X post was timely because during this session the rep I was speaking with mentioned a component of their offering where other competitors fall short. Their ICP was target towards CHROs and CFOs. The feature was something that mitigated risk for the IRS, something that other competitors did NOT have.

What was interesting is that then brought up more questions that easily turned into cold outbound messaging. For example, what does a CFO care about?

Cash Flow

Margins

Overhead

Compliance

Are these all the things that a CFO cares about?Probably not, but safe to assume these are on the list. From a compliance perspective, CFOs WILL care that there are gaps ESPECIALLY when it comes to the IRS.

So why not lead with that?

You don’t have to be call out that other competitors don’t have it, simply take the prospect down a line of questioning that gets to the point and highlights the gap.

It might not get a meeting but it WILL get attention.

Leveraging past companies and experience (not UserGems)

A prospect that has familiarity with your company is always going to be low hanging fruit - but what if we expand on that?

Let’s say that they’ve had exposure to a competitor before?

What if they didn’t directly come from a previous company but one of their former roles was where they had purchased?

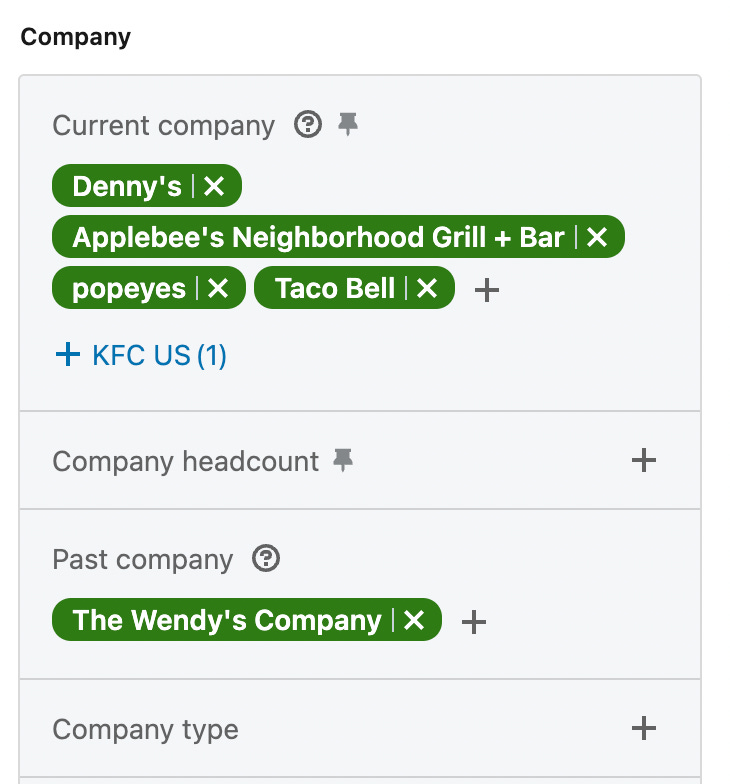

You’ll need LI Sales Nav for this, but it’s an easy filter:

You can also use the filters below:

This will help you just use a list of existing accounts within verticals or your whole account list.

Why is this important?

Part of building familiarity isn’t just knowing a brand - it’s understanding the language or the challenges that you or your product solves. Even if it’s with a competitor.If you know your persona then you can use this tactic to go a level deeper to start filtering who might be aware or has faced those challenges in the past.

Oh and you don’t need to spend more on tech like UserGems (at least to start) - in order to take advantage of this.

Tightening up industry/vertical specific messaging

One of the other challenges that comes with messaging is also being hyper specific to what a certain segment of the market is going to face. For example, maybe a manufacturing company and a QSR company will have challenges when it comes to HR software and employees.

BUT

Think about the nuances - QSR employees might have more hourly wages or higher turnover. Manufacturing companies might have personnel that are unionized.

I don’t know enough about manufacturing or HR software - the point is that I don’t need to know much to draw this conclusion.

In this example from a script, we can simply pivot and tailor towards finance leaders who work in QSR or Manufacturing. This establishes more expertise and it’s a relatively light lift. For example:

“Okay, so many QSR finance leaders who we work with tell us they have their attention on reducing overhead costs to mitigate against low employee retention, boost staff loyalty, and enhancing employee well being - do any of these resonate?”

It’s a small tweak, but the nuance is important. Additionally, it doesn’t require THAT much work to help to set up more targeted messaging that although is the same, is tailored more towards QSR industry which I explained above.

I employ these tactics to identify prospects who might know or have been exposed to my type of offering before - making it easier to connect the dots on how we can solve a potential problem.

As always, thanks for reading and see you all next week. If you have any questions or thoughts, shoot me a DM or email andrew.kobylarz@hackingsales.xyz.

-Andrew K

PS - if you liked this article, feel free to give a “like”, “comment”, or “share” with your network.