The Art of Becoming the Big Fish in a Small Pond

Asking the deeper questions to get ahead in any opportunity

A few months ago I cam across an interesting post from Sam Jacobs, CEO of Pavilion, on LinkedIn. Original post here, screenshot below:

What’s fascinating is that all my peers, network, and even across the interwebs, it seems like this statement is becoming a reality before our very eyes. It got me thinking, if I was in scenario where I was once again looking for an opportunity, or evaluating one, how could I leverage myself to be the big fish in pond of small applicants?

The thinking here could be applied in many scenarios. You’ll notice that I geek out on ChatGPT and AI. But I know that this isn’t a magic bullet. That magic bullet, or pill, doesn’t exist. It certainly does make you do tedious things faster, and open up mental bandwidth to arrive to more critical thinking in a world where relevance is more important than your ICP or a “personalized” email.

Asking the right questions, in interviews and in sales, especially the hard ones, are what gets you ahead. Those questions don’t have to be targeted towards prospects or hiring managers either, but for yourself. Here’s a quick breakdown on what we’ll cover today:

Resources to better understand markets/industries

Resources to understand trends

Connecting the dots with some real world scenarios

Resources on markets/industries

Below you’ll find compiled resources on different areas of SaaS to get a lay of the land. I’m sure that this isn’t the end all be all, there are multiple resources for this. Here are some I’m familiar with:

Matt Turck - MADD Landscape

Chief Martech - Martech Supergraphic

Google “CB Insights (insert industry) landscape - ex. CB Insights AI Landscape

***Note that you can also sign up for a free trial for 7 days and you get can more in depth reports.

This will start helping you draw conclusions and also niche markets that might not be getting a lot of hype and attention. When I was interviewing, I found that there was a ton of opportunity in AI within the R&D and Supply Chain space. And it’s an easy way to break down each industry and the segments of it in each graph. This will typically lead to more questions around trends, solid products, etc.

Trends

Here’s where you get good advice from investors, ie VC and PE newsletters or editorials. Given they do this for a living, it’s interesting to get their insight. I’ve provided a few of my favorite below:

SaaSletter - great infographics which break down various mechanics of trends in the industry and where the money is going.

Tidemark “The HighPoint” - VC publication on all things startups. This particular article caught my eye: Platforms of Compounding Greatness

OpenView Partners “OV Blog: VC publication on all things startups.

There is undoubtedly a lot more. Tidemark’s Platforms of Compounding Greatness really got me thinking about certain trends in the tech industry and successful companies seeing success amidst a rocky macro economic environment.

Connecting the dots with some real world scenarios

Many times people look or find the information from the top sources. I’ve shared some above. This draws you to the conclusions of the masses, where everyone is fighting for the same opportunities. Nothing necessarily wrong with that, but in a pool full of thousands, how do I get to a pool of hundreds that’s just as valuable?

Like any good discovery, it’s the second, third, or even fourth questions that get you to the truth of the matter. A lot of this thinking is like investing as well, it’s too expensive to pay for the stocks that have already made it. Do you want that in your portfolio? Sure. But you also want your money in stocks that have the potential for exponential growth.

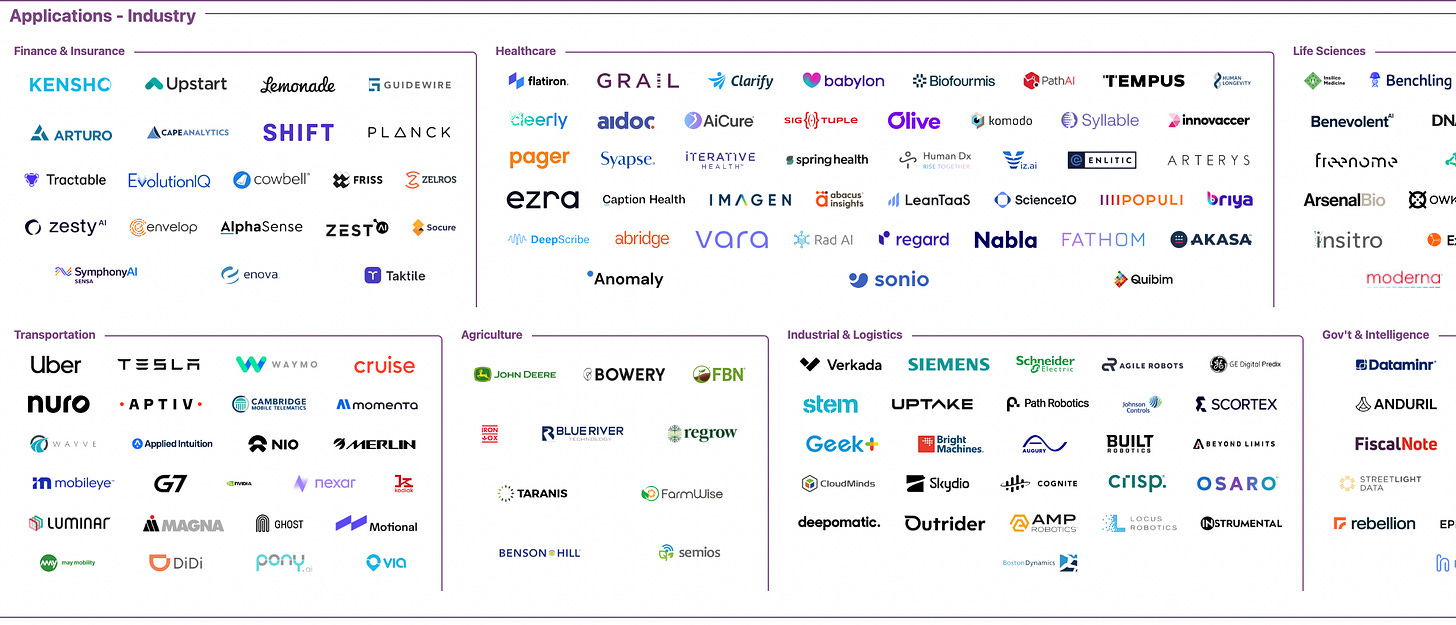

So let’s pretend I’m a candidate who’s an SDR interested in AI, and wanting to land a remote job. I’ve pulled up my MADD landscape because I want to get a remote job in the AI industry:

If you look at the map, in the bottom right hand corner, what catches my eye is industry specific applications. Reason being is that you if you read the Tidemark article, last year trends in valuation and growth were centered around vertical SaaS, ie something specific to a vertical. This trend, coupled with being an offering that isn’t a single point solution (ie a tool with one solution), shows where the money is going.

You don’t necessarily have to pick one of these companies in the chart above. But think about what most people talk about - how to break into AI, infrastructure, data, etc. Common logos that come to mind are companies like OpenAI, Databricks, Google, Amazon, etc.

If you want to get a job there, go for it. Just consider that you’re playing in a pond with a lot of fish. Don’t put all your eggs in that basket. Some interesting industries that are being disrupted right now are in life sciences, or supply chain. Ie Benchling or Makersite. All of which are both very lucrative industries, being disrupted by software. But no one really talks about that.

All this to say, maybe those could be some interesting options that can get you ahead of the pack and still position yourself to be in a very good position to stand ahead of the pack.

With that, I noticed a post on Twitter highlighting the fact that a remote post for an SDR:

You can find similar posts for in person roles that have an applicant pool of 30 - 50. THAT IS A GAME CHANGER.

Combine these two things together and you can see how you can position yourself as a very strong candidate without having to push against the masses. Another point as well, in the resources I provided above, is that going after the coveted enterprise role right now is the *not* the place to be. If you look at ENT quota versus MM quotas, mid market is performing extremely well vs enterprise teams.

Conclusion

All in all, there is never the right *answer*, only the right *questions. This certainly isn’t a post to talk about staying away from a F500 brand, there are a lot of benefits to companies like those, along with ways to crack into them. But as the saying goes, work smarter, not harder.”

As always, thanks for reading. See you again next week.

-Andrew Kobylarz