The Framework that Turns Financials Into Messaging That Lands

A Repeatable System (and Prompts) for Understanding Any Company in Your Pipeline

Last week we talked about the importance of selling in a business vs running a business.

The shift hinges on one question:

How would a CFO look at this?

Before jumping into live financial teardowns in future posts, this week is all about the overarching approach. It’s the thinking model you can reference every time you analyze a company. The goal is a resource you can use across every account you’re prospecting.

I’ll also show you how to pair this workflow with ChatAE, a platform that is integral to my daily workflow (transparency: I’m affiliated). However, you can replicate everything using GPT, Perplexity, Claude, etc.

I’ll be tearing down real company financials to show:

how to derive a narrative

how that narrative becomes a business hypothesis

how that hypothesis turns into clean, relevant messaging for line leaders and ICs inside your ICP

This framework is a running theme - think of this as the “master doc” we’ll keep referencing.

What We’ll Cover Today:

The business engine

The financial signal

The strategy that matters to leaders

The sales translation

If you want me to do a breakdown on your target account, message me - this stuff has been fun and extremely useful for me, and it’ll turn into a reference library you can build on.

The Business Engine

The first step in any financial teardown is understanding how the business is organized and how it actually operates.

Start with the basic segmentation inside their 10-K, annual report, or investor materials.

This tells you where budget likely sits:

Is budget centralized or distributed?

Is spend per segment, per BU, or per functional owner?

Who owns strategic vs operational outcomes?

During discovery or outreach, you’ll have to validate and pivot off of what you learn. As I’ve shared before, getting to the right answer is an iterative process. And the quality of your questions determines the quality of your answers.

How the Business Makes Money

Once you understand the structure, zoom out and look at how the company actually earns revenue. This is the economic truth behind every business - the “real job” the customer is paying for.

“If this company disappeared tomorrow, what core capability would their customers lose?”

Let’s use Salesforce as an example.

At a high level, Salesforce is a SaaS company, which provides a CRM. But really, the core capability they provide their customers is revenue infrastructure for predictable growth.

Other examples:

Snowflake → not “cloud data,” but data liquidity (turning data into an exchangeable asset).

Adobe → not “creative tools,” but monetizing creativity (turn ideas into output).

HubSpot → not “marketing automation,” but growth orchestration (align acquisition motions).

When you reframe companies this way, you start seeing patterns, and patterns become prospecting shortcuts. Especially helpful when a company is private and doesn’t have public financials you can access.

The Financial Signal

Now that you know what the business is, you can understand what metrics matter. Every company optimizes around four universal levers:

Topline: How fast is revenue growing? Where is growth concentrated (net new, existing expansion, or price)?

Profitability: For each dollar in, how much comes out? What are the margins?

Efficiency: How well-oiled is the machine? Are they growing without expenses scaling linearly?

Cash Flow: How fast do they collect? How quickly can profits be converted to usable cash?

Simple prompt: What are the key financial metrics that (company) is focused on based off of the most recent financial reports?

The P&L isn’t just a report card, it’s a story.

A story that tells you:

where the business is strong or weak

what leadership is trying to optimize

what the company is betting on for future growth

where cost pressure or strategic prioritization actually show up

This is REALLY important.

When you’re selling a product, you’ll start noticing trends and patterns based on a category. You’ll be able to articulate to prospects what you’re seeing in the market. This establishes domain expertise and trust.

You’re not a seller anymore, you’re a trusted operator.

For one of my ICP categories, companies will almost always will fall into one of these buckets:

Cost discipline / OPEX control → efficiency & faster payback.

Volume-led growth → speed to learn, launch, iterate.

Margin expansion → mix improvement and waste reduction.

Cash flow focus → lower time-to-value and less working capital tied up.

These patterns help me:

know where to focus prospecting

craft business hypotheses quickly

message in the language of executives, line leaders, and IC’s

evaluate private companies even without public filings

When you can do this, you’re being proactive. You’re seeing where the company is headed, giving you the ability to shape narratives and strongly position yourself against competitors.

Timing is everything in sales.

The Strategy that Matters to Leaders

Financials only give you the what, but you still need the why.

This is where you combine:

CFO commentary

earnings calls

press interviews

industry trends

trigger events

headcount changes

cost structure shifts

leadership mandates

And more …

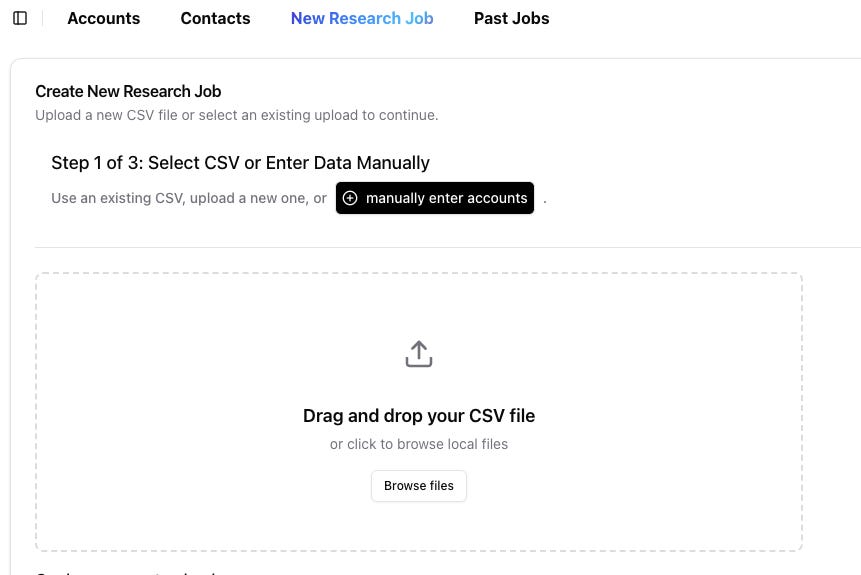

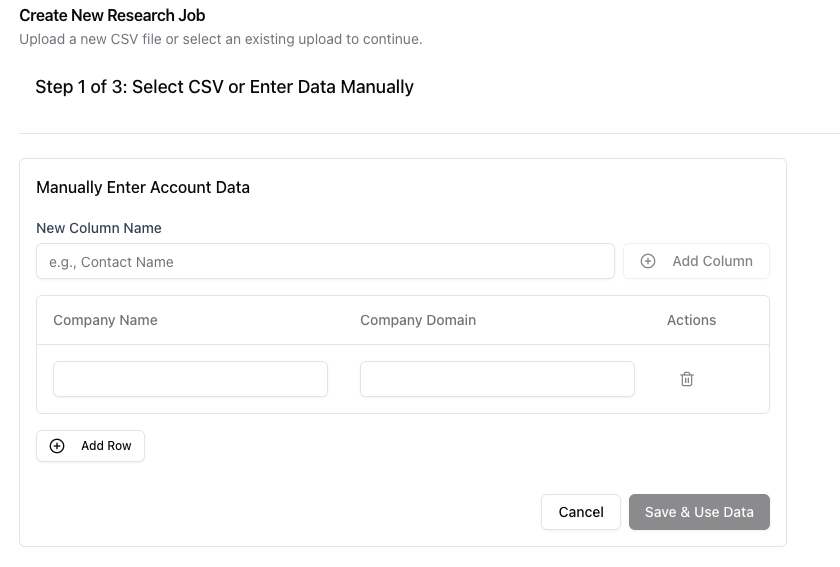

You can do this in ChatAE >New Research Job

Upload CSV or manually enter account(s)

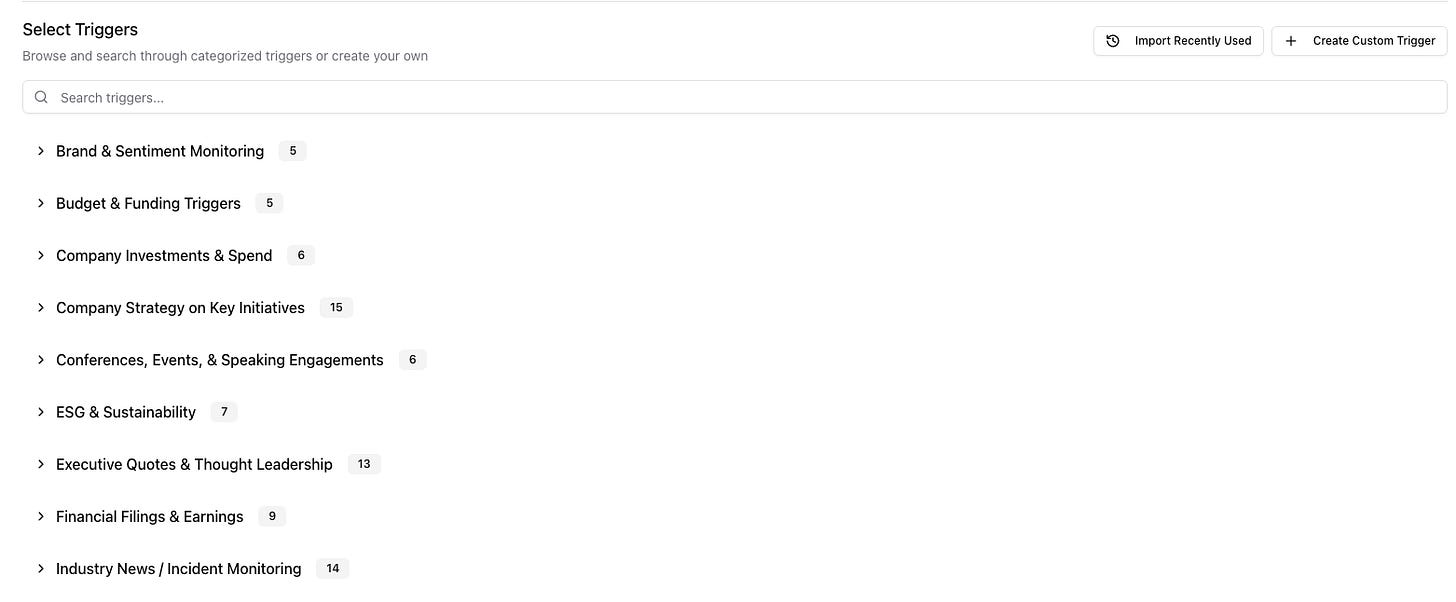

Use predefined or custom triggers

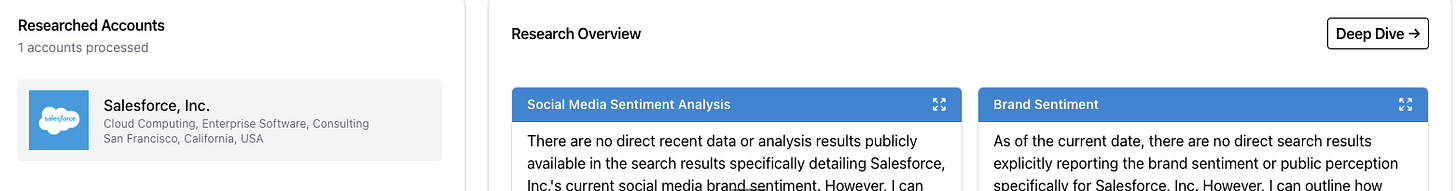

Scroll to “deep dive”

Prompt:

Based on the most recent financials, can you help me understand:

1. What are the CFO top initiatives?

2. What are the top strategic initiatives is (company) prioritizing?

3. What are the top challenges that (company) is facing?

This helps develop your prospecting and messaging strategy. And most importantly, helps you map where your solution fits in the org.

The Sales Translation

Here’s where things start to click. What stands out at a quick glance:

cost optimization

data-driven spending

operational excellence

The CFO, and the org, are looking to reduce OPEX and measure investments that demonstrably tie back to ROI. This is the narrative.

***Note: Day to day, this is the step that takes the most time - as it should. Remember, you use AI to collect and summarize information quickly. The real value comes from your ability to synthesize it, form a perspective, and translate that into a narrative that resonates with the right personas.

That’s the human skill. It’s what separates meaningful outreach from the AI-slop your prospects are getting.

The upfront work is hard, but it pays dividends. More importantly, it’s where you make your money.

If I were selling, say, a developer platform like LaunchDarkly, I’d weave that narrative into my messaging. We’re not pitching “feature flags”.

We’re helping provide Salesforce with a software efficiency platform - converting developer work into quantifiable, ROI backed outcomes.

ship faster without added risk

isolate cost + performance impact

reduce engineering waste

convert developer work into measurable ROI

Example:

“Companies like Salesforce are under pressure to prove operating leverage and show that every new dollar invested in engineering returns two in product performance, customer retention, or ARR.

LaunchDarkly gives product and engineering leaders the control, data, and speed to do exactly that: ship faster, waste less, and measure impact in real time.”

Now you’re selling capital efficiency, not software.

It’s a solution to the hypothesized problem.

Which is the whole point of the framework.

Translate financial reality → strategic priority → distill to persona-level value.

Now, this framework isn’t a magic bullet. You have to talk to people and validate.

Next week, we’ll apply this framework to a live financial teardown of a real account.

Hope this is helpful. If you have questions, shoot me an email or DM. To all my sales FRENS in the US - enjoy Turkey Day and Happy Thanksgiving.

***If you want me to break down your target account, shoot me an email or DM me. I’ll include it in future editions.

If you have any questions on this topic or thoughts, shoot me a DM or email andrew@hackingsales.xyz.

As always, thanks for reading and see you all next week.

-Andrew K

PS - if you liked this article, feel free to give a “like”, “comment”, or “share” with your network