Financial Teardown # 1: Salesforce

Translating the Salesforce P&L into a business narrative sellers can use

For those in the U.S., hope you had a great Thanksgiving and are still living off leftovers.

Over the past couple of weeks, we talked about the difference between running a business vs selling in it, and the framework you can use to synthesize and message based on what you learn from a company’s financials.

The core question being:

How would a CFO look at this?

Each teardown will focus on one enterprise company and then show how to position 1–3 different companies as if you were selling for them.

The structure is simple:

Read the business engine → translate the financial reality → strategic priority → build the narrative → distill to persona level value

NOTE: If you have an account you’d like me to teardown, DM or email andrew@hackingsales.xyz. Subscribers will be prioritized. Requests featured will maintain confidentiality unless otherwise approved.

Financial Teardown # 1: Salesforce

What we’ll cover today

The business engine

How the business makes money

The financial signal

The strategy that matters to leaders

The sales translation

The Business Engine

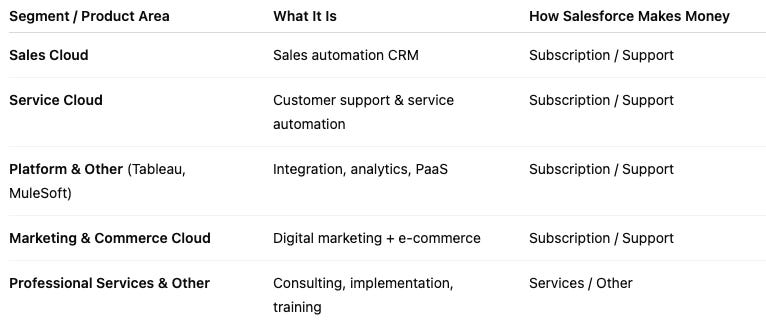

Salesforce is broken out into five key sectors:

Takeaways:

Segmentation across these sectors imply that P&L accountability is distributed across each cloud. So each unit will most likely have it’s own GM, financial targets, and product specific priorities.

Despite having separate semi independent businesses inside a shared ecosystem, there are most likely more line leaders based on geography, products in a suite, etc. You have to talk to prospects to validate and understand the org structure to get this information.

Salesforce’s entire model is built on annual recurring revenue (ARR), but professional services is not. If money is lost here, that’s probably okay. It’s purpose serves to de-risk investment or accelerate activation for a customer. This feeds initial lands, up sells, cross sells, which increase the life time value (LTV) of a their customer base.

How Does the Business Make Money?

When you think of Salesforce, you think CRM. But really, Salesforce provides their customers with revenue infrastructure for predictable growth.

Every segment aligns to revenue outcomes:

Sales Cloud: “Sell more”. Pipeline, lead management, CRM.

Service Cloud: “Serve better”. Support, ticketing, automation.

Platform: “Connect everything”. Workflows, custom apps, data integration.

Marketing & Commerce Cloud: “Find and Convert”. Campaigns, customer journeys, personalization.

Professional Services: “Get it Set Up Fast”. Implementation, training, and support.

It’s a platform ecosystem designed for expansion and “stickiness”. Once a customer lands, the next offering is always within reach. The deeper a customer is embedded into the ecosystem, the harder it is for them to churn.

The Financial Signal

Topline

Subscription revenue expansion

Multi-cloud adoption

RPO (future contracted revenue)

Takeaway: growth is steady, but leadership is optimizing for quality over speed.

Profitability

Margin expansion

Net income improvement

EPS growth

Takeaway: Salesforce must prove operating leverage. Every function is expected to produce more value per unit out of every dollar that goes in.

Efficiency

This is the link between margins and AI investments

OPEX control

GTM productivity

R&D leverage

Takeaway: operational excellence is not optional; it’s how Salesforce funds the AI roadmap.

Cash Flow

Robust free cash flow

Strong deferred revenue

Predictable cash generation

Takeaway: cash needs to be measured and tied to outcomes; ensuring Salesforce can continue to invest aggressively in AI amidst a tight macro environment.

The Strategy that Matters to Leaders

What the CFO Cares Most About

Cut costs without slowing innovation - especially around AI and automation.

Use data to justify every dollar spent - procurement, vendors, internal operations.

Automate finance workflows - better forecasting, fewer manual processes.

Create long-term value - reinvest efficiencies back into high-growth areas.

CFO Mandate: make Salesforce more efficient today while still funding the AI future.

(Efficiency mandates aren’t isolated to tech. Across industries, volatile macro conditions are pushing CFOs toward the same playbook: tighten spend, increase productivity per dollar, and de-risk future investments. It’s one of the most common cross-category patterns I see.)

What the Company Is Focused On

AI everywhere - embedding AI into every Cloud and workflow.

Customer-centric growth - deeper industry solutions, better customer experience.

Global + product expansion - more markets, vertical solutions, translates to a bigger ecosystem.

Operational excellence - automate more, streamline more, ship faster.

Responsible tech - data privacy, security, sustainability.

Strategic Initiative: Salesforce is doubling down on being the AI leader for enterprise software AND the most operationally efficient version of itself.

What’s Getting in Their Way

Even with strong execution, Salesforce still faces meaningful headwinds:

Heavy competition (Microsoft, Oracle, HubSpot) pushing pricing pressure.

Balancing cost cuts with innovation needs - AI investment is expensive (duh).

Macroeconomic uncertainty reducing enterprise IT spend.

Talent tightening after workforce reductions and restructuring.

Data privacy + compliance as AI and cloud scale globally.

Challenges: Salesforce needs to evolve fast enough in AI while managing costs AND competition.

The Sales Translation

This week, we’ll break down how to position the overarching narrative for the following companies:

1. LaunchDarkly

2. Gong

3. Perplexity

1. LaunchDarkly

If I were selling a developer platform like LaunchDarkly, I’m not pitching “feature flags.”

I’m helping Salesforce build a software efficiency platform - converting engineering cycles into quantifiable, ROI-backed outcomes that support the CFO’s demand for innovation with discipline.

Value pillars:

ship faster without added risk

isolate cost + performance impact

reduce engineering waste

convert developer work into measurable ROI

accelerate safe AI experimentation

Example narrative:

Companies like Salesforce are under pressure to prove operating leverage — to show that every new dollar invested in engineering produce positive returns in product performance, customer retention, or ARR.

LaunchDarkly gives product and engineering leaders the control, data, and speed to do exactly that: ship faster, waste less, and measure impact in real time.

2. Gong

If I were selling a revenue intelligence platform like Gong, I’m not pitching “call recording.”

I’m helping Salesforce operationalize a revenue efficiency system. Helping transform customer conversations into predictable, measurable signals that support the CFO’s push for margin expansion, GTM discipline, and customer centricity.

Value pillars:

improve GTM productivity without increasing headcount

strengthen forecast accuracy with real buyer data

identify deal risk early to reduce pipeline waste

reduce onboarding and coaching cost

unify GTM insights for AI-powered execution

Example narrative:

Salesforce is under pressure from competition and needs to prove operating leverage across its GTM motion , demonstrating that every dollar spent on sales produces more predictable revenue.

Gong gives revenue leaders real buyer intelligence, improving forecast accuracy, accelerating rep ramp, and reducing GTM waste.

Every customer touchpoint converts into performance data the business can act on, enabling Salesforce’s GTM teams to be more resilient amidst competition, prioritize for cash conversion, and better understand the customer to increase LTV.

3. Perplexity

If I were selling an AI research platform like Perplexity, I’m not pitching “AI search.”

I’m helping Salesforce deploy an intelligence acceleration platform. Compressing hours of research, analysis, and synthesis into minutes so teams can execute the company’s AI strategy without expanding OPEX.

Value pillars:

reduce research time for GTM, finance, and product teams

accelerate competitive and market analysis

support forecasting and strategic planning

improve cross-functional alignment through shared insights

increase decision velocity across clouds and markets

Example narrative:

Salesforce needs to innovate in AI while keeping operational costs tight. Perplexity gives every team, from finance to product to GTM - a faster, AI-native way to research markets, buyers, and competitive moves.

It compresses hours of manual analysis into minutes, helping Salesforce move faster with fewer resources. Perplexity amplifies the company’s operational intelligence without increasing headcount or resources.”

Closing Thoughts

When I’m prospecting, the narrative is my anchor for the entire sales cycle. It guides which accounts and personas I prioritize, and how I distill the core financial themes into messaging that actually land with each line of business. I’m also intentional about reading what tools like ChatAE (or any LLM) surface, instead of blindly copying it, so I can validate the inputs, stand behind my POV, and ensure I truly understand.

That same narrative becomes the backbone of the collaborative roadmap I build with prospects: where our solution fits, how it creates leverage, and how it ties back to ROI. It shows where we help, how we help, and makes the investment defensible.

Does this take time? Yeah. But the upfront work makes the rest of the sales cycle MUCH easier. Taking time to synthesize is the separator. It’s what pulls you out of the noise of hundreds of generic outreach emails.

The narrative you build upfront becomes the through-line for every conversation, email, and deal review. It’s the anchor of the entire motion - don’t half-ass it.

Hope this was helpful.

If you have an account you’d like me to teardown, DM or email andrew@hackingsales.xyz. Subscribers will be prioritized. Requests featured will maintain confidentiality unless otherwise approved.

Any other questions, comments, thoughts? Send them my way, contact info above.

As always, thanks for reading and see you all next week.

-Andrew K

PS - if you liked this article, feel free to give a “like”, “comment”, or “share” with your network

This is awesome.

The LaunchDarkly positioning is brilliant because it reframes a developer tool as an operating leverage instrument. What makes this especially sharp is recognizing that Salesforce's margin expansion mandate creates a capital allocation filter where every engineering dollar needs demonstrable ROI. The insight that feature flags convert engineering cycles into quantifiable outcomes addresses the CFO's core anxiety: how do we fund AI innovation without destroying unit economics? One dimension you could push further is the temporal arbitrage angle. By reducing deployment risk through gradual rollouts, LaunchDarkly doesn't just optimize current spend efficiency but also compresses the feedback loop between investment and validation. This turns the traditional R&D trade-off where you either ship fast with high risk or slow with high certainty into a third option: ship incrementally with real-time risk adjustment. That's not just cost leverage; it's velocity leverage that protects margins while accelerating learning. The real value prop becomes: you can afford tobe more experimental because the cost of being wrong drops asymmetrically.