From Data to Decisions

Prioritizing where you should spend your time

Quick Update: As I’m sure you all know, ChatGPT has launched the GPT store and there are hundreds of custom GPTs in the marketplace.

One of the things that I’m bullish on is using AI to not only help with mundane daily tasks but also help me think about how I can refine and iterate tactics against a strategy, or the overall strategy itself. A personal “Jarvis”, if you will.

I’d love your feedback, can you help by filling out below?

Last month I shared the exercise of how I approached creating a sales strategy using AI against my account list. The exercise ended up surfacing more questions than answers about all the data I can start leveraging to figure out how to attack my goal of 3x’ing my quota.

The problem is that strategy is all well and good but there needs to be actual doing.

“Everyone has a plan until they get punched in the mouth.” - Mike Tyson

In reality, theory and strategy is nothing without feedback loops to ensure progress. With this in mind the goal at first was to have a plan but ultimately evolved into this:

Where can I find the quickest paths to revenue?

What trends or patterns can I capitalize on based on historical data?

How do I prioritize my time?

I’ve covered the first two bullet points in previous posts so I’ll just provide a quick summary.

From there, I’ll dive into how you can take your account list and ask questions that help paint a picture of prioritizing where to spend your time, along with how I used AI to do it.

Where can I find the quickest paths to revenue?

I wrote about this framework last week to help you quickly find leads that could turn into quick wins.

That helped me surfaced a quick lead list to hit the ground running. With low hanging fruit out of the way, this led me to wonder:

What trends or patterns can I capitalize on based on historical data?

What data could I find on past historical spend within an account or industry?

Are there any trends that I can find within a specific account industry that show patterns or trends that I can map back into a quarterly cadence?

Keyword searches for products, timing, initiatives, across closed lost or past deals that I can surface in Gong?

Can I upload certain transcripts (redacted) and find patterns?

I was able to find most of this data by sifting through historical usage in Tableau, Gong, and Salesforce.

So now I need to start DOING.

Which leads me to the main topic of today:

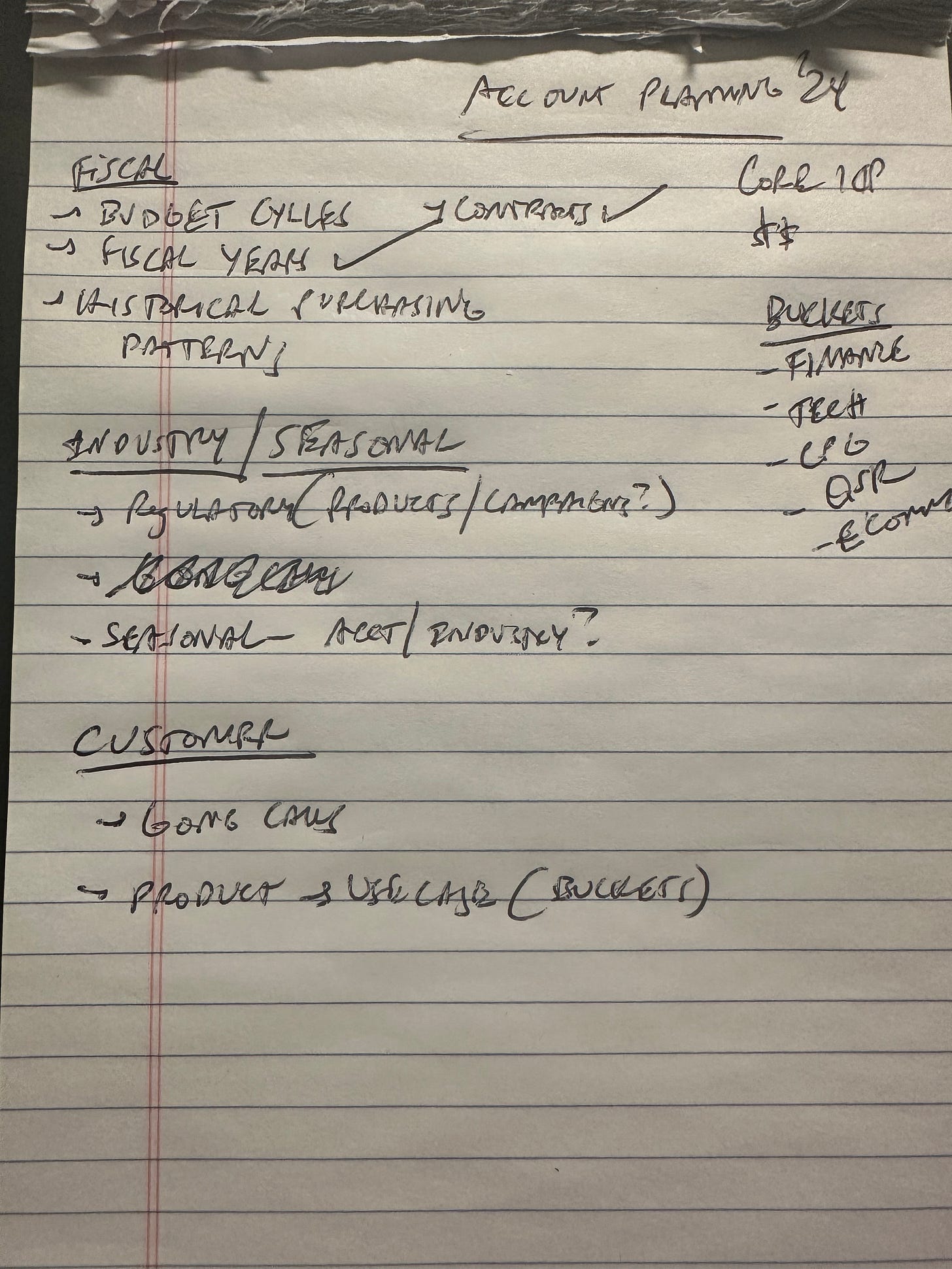

How do I prioritize my time?

I’ve got to make some strategic bets that will get me to 3x my quota. Worst case, I land at quota, but how should I approach this?

With some of the items above I started thinking through a few things that would make big bets relatively safe while also protecting downside (ie not having pipeline or hitting my number).

If one account gets a ton of momentum that will impact my number significantly, in a positive way. I can mitigate risk by taking focusing on a select few accounts, combined with all the tactical day to day of using intent signals from 6sense and UserGems, along with general prospecting - spread across the rest of my book.

I put together a simple excel sheet with the following column headers:

Target ICP

Annual Revenue

Estimated Total Spend for Category

Untapped Business Units/Subsidiaries

Current Use Case Spend

Historical Spend with Current Org

Potential Use Case

Growth

Subjective context:

What's the relationship with current team (ie referrals)?

What’s the influence my core buying persona holds at an org? (ie heavily leans, and needs, what we can solve for?)

Most of this info I had to dig into internally. I used perplexity.ai to quickly find any publicly available info (ie annual revenue, total category spend, subsidiaries). It’s worth noting that I have a smaller set of accounts, less than 25.

If you have a larger set of accounts, I’d play elimination after scrubbing the company data around annual revenue, estimated total category spend, and how that matches against your target ICP. You can further refine this with the data I mentioned above.

This exercise is simply following the money.

Identifying total spend and revenue linked to all can help me guesstimate where the money flows, which is where I should be going.

Easier to swim with the current than against it.

This landed me in a position where I have 5 accounts which I can heavily focus on based on all the factors above. Again, the rationale is that I can make big bets in that part of my book, and mitigate risk with activity across 20 accounts.

The cool thing about this is that I can now take this framework continue to refine and iterate, against tactics or even my overall strategy. It’s malleable enough to pivot based on current events or market feedback now that I have a decent picture of how to execute.

I’d like to explore is how to put this into a custom GPT in order to execute the task above. It’d be even more interesting to develop a framework that encompasses the nuances of what someone would see in their GTM motions on a day to day basis.

Is this going to be perfect? Probably not.

But nothing ever is.

As always, thank you for reading and see you next week.

-Andrew K

P.S. if you’re someone reading this who is more technical, I’d love to chat with you about how to build a custom GPT that would be able to capture nuances of someone’s GTM motion. Feel free to email andrew@hackingsales.xyz or book some time with me.